Podcast - Adam Savage Project

This Is Not Financial Advice – 4/28/2015

Adam, Will, and Norm discuss money, credit, our past mistakes, and credit counseling services. .

Whalerock

Adam, Will, and Norm discuss money, credit, our past mistakes, and credit counseling services. .

One Day Builds

Adam embarks on one of his most ambitious builds yet: fulfil…

Show And Tell

Adam recently completed a build of the royal St. Edwards cro…

Making

Viewers often ask to see Adam working in real-time, so this …

One Day Builds

Adam and Norm assemble a beautifully machined replica prop k…

One Day Builds

One of the ways Adam has been getting through lockdown has b…

Making

Adam unboxes and performs a quick test of this novel new hel…

Making

When Adam visited Weta Workshop early last year, he stopped …

One Day Builds

Adam tackles a shop shelf build that he's been putting off f…

Show And Tell

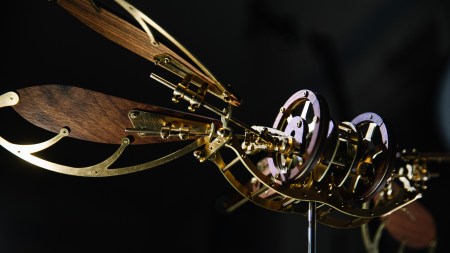

Time for a model kit build! This steampunk-inspired mechanic…

One Day Builds

Adam reveals his surprise Christmas present for his wife--a …

My parents only thought me one thing about personal finances. If you buy something an credit you can’t afford it. The only thing you can buy with credit is a house they said. Has served me well. I can also recommend only having a debit card. 0 credit on your card. Makes it a lot easier not to use it. I think it is valuable to teach your kids to wait and save to be able to buy what they want. Gets rid of impulse purchases as well, because you can’t!

I don’t really understand what you guys mean by “Balancing a checkbook”. Probably because I’m Swedish. Is it just keeping a budget?

Basically yes, specifically it means keeping track of all your expenses and income to make sure your records match your accounts, i.e. those two numbers being balanced.

Do people in America actually still use checks and balance checkbooks? I’m 40 years old and Canadian, I’ve only ever used a debit card and have never carried cash or used checks and for at least 15 years have done all my banking online.

I’ve had a checking account for more than twenty years and just a couple months ago got my first actual physical checkbook, purely because I needed a voided check because the Canadian government is forcing everyone to go direct deposit for tax returns and the like.

For the more nerdy or text file oriented readers, I recommend ledger to start running … well, a ledger. Link: http://www.ledger-cli.org/

There are some Google talks (recordings of ~1 hour talks by people who presented on Google campuses/campi(?)) on Youtube by financial advisors who wrote books and who give a good overview on the topic which you can probably also watch with kids.

My personal motto is to wait about the amount of digits in days before making a bigger purchase that is not 100% neccessary (e.g. want to buy a 1300€ laptop? Wait 4 days first.) and only if after this “time-out” I still without doubt or reservations want to purchase the stuff, then go ahead.

Edit:

Podcasts: In general I like freakonomics, since it generally seems to encourage you to think about money or incentives/payoffs.

Most of the stuff in personal finances though is anyways “common sense”, it’s just that it requires a certain discipline with your actions and purchases. Helping kids to just create 1-2 folders of “important stuff” (e.g. keep invoices for expensive goods in case you need to claim the warranty, file away bank statements and credit card balance sheets regularly, store contracts for insurance, rent or investment plans in a place where you can easily find them) might be just as important, since they can then later check back on their financial history once they start to get into trouble or want to find out more.

If your first reaction to receiving an invoice is to look at it if it is correct and then file it away, I doubt that you’d manage to get into as much trouble as someone who just throws it into the “unopened invoices that I might have to pay some point in the future” bin.

But can’t you just check your bank account?

I feel like I am missing something so I’m going to do a simple example.

I go grocery shopping for the week and I am unshure if I have that much cash in my account. So I pick up my phone and check the bank with my app. Transfer the money (if needed). Then I pay.

Can’t you make those mic stands from a swing arm lamp? Just replace the lamp with the mic holder.

I do all my banking online with my phone or tablet. You can try the bank app (op mobiili) with user name 123456 password 7890 and with any 4 number key code.

There’s also another banking app that I use to track my spending (Pivo wallet). And by the end of the year this app should work like a NFC payment card.

I made a bunch of money mistakes when I was between 18 to 22 (school costs, credit cards, etc) and am still paying for some of it but thankfully I’ve gotten a good enough job that it isn’t a major stress anymore.

The single biggest thing I did was read a book titled ‘Money Rules’ by Gail Vaz-Oxlade (she’s actually got a whole series of these but this is the most general) and it taught me how to effectively manage myself instead of letting my money control me and what I do. Hopefully in the next year, myself and my SO will be buying our first house together, so just a lesson that anyone can dig themselves out if they work hard enough.

I understand your confusion. I’m also European, but a friend of mine who works in the American banking system explained this to me.

The American credit card system encourages people to use more money than they have on their accounts. You can go into wild minuses with the credit cards, and where overdrafts on European credit cards are paid back in full at the end of the month, American credit cards allow you to pay back in monthly instalments. So if you have a minus of, say, 2000$, you don’t pay all that back within the end of the month. The credit card companies and presumably also banks earn huge amounts on the overblown interests of the overdraft, so they actually award people who have enormous overdrafts: If they pay back regularly, their credit rating goes up. conversely, people without overdrafts do not earn any credit ratings at all. Where we have to show that we don’t overspend in order to get a house loan, they have to show that they regularly overspend, and pay it back.

Since most Europeans I know would rather be caught masturbating in public than have a minus on their account or credit card at the beginning of a month, we wouldn’t ever talk about “balancing checkbooks”.

I got given the book “Rich Dad, Poor Dad” by Robert T. Kiyosaki to read as a teenager (about 16 years old). It gave me the basics of why you should manage your finances. My parents then told me to only spend money you have and got me to open a Debit account only. I did take up credit cards later on, but I never put them in my wallet and by filing them in a folder (they were never available when shopping and then only available if I had some sort of financial crisis). Basically I made the credit cards, out of sight and out of mind. Also, I was also told by my parents (and now know from experience) to leave a cash buffer in your account if you have regular expenses too, as multiple draws from your account (for bills/etc) can take you into overdraft if you are not careful. These days, I think the easiest thing to do is to open multiple bank accounts. One for bills, one for saving and one for spending (only having the spending card with you in your wallet) and do a 50/20/30 split of your income into those accounts. It makes for a solid basis for managing money.

I would also recommend a fake share trading game with your children too (tell them so select $50,000 worth of shares and then at the end of a month you re-assess the shares position). This makes them interested in saving, gives you an opportunity to explain the share system and allows you to explain financial concepts such as diversification (which is really important).

That “deadbeat” comment reminds me of one of the best pieces of advice I got about credit. When I got my first credit card I was already moved out and living on my own and going to college. And the fellow at the bank who was signing me up for the credit card told me, “If you pay off your balance every month, you are a bad customer for the credit company. They don’t want you paying off your debt, they want you paying interest.” And there’s a satisfying feeling about being an annoyance to a company that relies on exploiting and impoverishing it’s customers.

Thanks. I personally would not be able to sleep if I had a negative balance.

I therefore “only” have a debit card which is probably why I was confused.

In the Netherlands it’s very unusual to have credit cards. I have one but is part of a debit account so must be paid the next month. It’s mostly used for online payments to other countries. I don’t think anyone uses cheques anymore. Most people have debit accounts and cards.

Everything is set that I can’t buy stuff when my account reaches zero, for the simple reason I don’t want to pay interest.

If you don’t have the money, you can’t buy it. That has worked out great so far, and I want to teach that to my kids as well. I can see a future where the ease of paying makes it hard to keep tabs on your expenses. On the other hand apps have made it very easy to see your bank balance.

Best money tip my parrents ever gave me was to buy a small house instead of renting. I’m 36 now and payed of that loan and now just bought a Holiday appartement that i can rent out when not using it.

Is it possible in the USA to get a European type debit card? That deels a far safer and beter option.

Love the deadbeats thing…

do you know what the banks call the opposite of a deadbeat? – it’s a ‘lemon’ cause you can squeeze and squeeze and squeeze again.

After looking a bit, I randomly stumble upon https://www.youtube.com/user/MikeAndLaurenTV which also seems like a decent short attention span, one lecture at a time channel for financial stuff.

I think whats more important than “balancing a checkbook” or not using a credit card is learn how to budget and how much things actually cost compared to your income. What I wish to have been explained to me when I was younger and even before college was the cost of living – cost of (must haves) rent, food, utilities, (needs) – phone, internet, transportation, (wants) – clothes, eating out, hobbies, etc. Then, compare those numbers to potential salary numbers i.e. “what if I make 25k a year? Will my budget fit inside that salary? 35K, 50k, 70k? Where do purchases for computers, cars, etc fit inside those models? Where do savings, an emergency fund, retirement fit inside those models? etc.

I think the best thing to do is actually work the math and see what the cost of living really is. Then you can bring in concepts of credit cards (advantages – points, theft reimbursement, credit score / disadvantages – interest if not paid in full, lack of immediate feedback in comparing to actual money in the bank)

Literally “balancing your check book” is sort of antiquated activity these days. It comes from before online banking and really before ATMs. The only way to know how much was in your account was to go into the bank during banking hours. All checks books, at least in America, come with a little ledger where you would keep notes on your balance and what checks you’d written to keep a running total of your balance. It was sort of a pain in the butt. Now that you can look up your balance online and send money instantaneously, the physical activity of balancing your check book is really necessary (I don’t know anyone under 35 who still does it); however, the concept of keeping track of money going out vs money coming in at a detailed level is still referred to as “balancing your check book”.

The only problem with not not having a credit card is that a lot of (online) retailers do not allow you to pay with a debit card or another way. Especially for international stuff. Other than that I wholeheartedly agree.

I went through the same crap when I first got into college. . .made a lot of uninformed decisions. I learned the hard way to keep my expenses down and to utilize free resources for books and movie rentals. I learned to cook because I found I was using the card too much for meals and drinks and that can get away from you in a hurry when your in your early 20’s. Now, I game my card as much as I can, by utilizing points and letting them add up to get fun stuff on Amazon.

This book was a good read about hidden fees and ways to get around paying extra money for no reason: http://www.amazon.com/Gotcha-Capitalism-Hidden-Every-Day/dp/0345496132

As for banks, I believe Miss Piggy said it best when she said: ” All you need to know about bankers… is that they attach little chains to their ball point pens.”

Laptobbe

I buy everything on credit and almost never use my debit card unless I’m at the ATM. Credit cards have better fraud protection (very important for someone who buys a lot online) and give rewards. I pay off the card every month, carry zero balance, pay zero interest, and get $20-30 in cash back rewards.

If you can keep to a budget without being limited by the cash in your bank, credit cards are fantastic tools.

One of the most important things I learned in college was how to be flat-ass broke. Like, I blew out my shoes so when we went bowling on quarter-night I just left my old shoes there and wore bowling shoes for the next two months until I could afford some new Sambas.

I work for credit union and we just did a financial literacy program with a local high school and it’s amazing how unprepared so many people coming out of high school will be. I think that a class on personal finance is something everyone should have to take. No matter what profession you go into (science, arts, etc.) the skills one could learn in a high school class like that would be helpful to everyone.

I’m Norwegian, as far as I know I haven’t ever had a negative balance in any of my accounts.

We europeans tend to pay everything using one or two accounts, using a debit card or scheduled direct bank transfers.

I had never even seen a check until I moved to the states.

In the US, it is apparently normal/acceptable to have a separate credit card for every major chain store and to pay with checks, credit, money orders, cash and debit cards in that order (not really, but kinda).

When I moved there, my landlord insisted on getting paid by a cashier’s check paid in cash rather than a direct deposit… this is a man who owns multiple buildings and deals with a lot of tenants. He told me getting a paper check for him with a copy for myself every month was better than a direct deposit from my account because “you’ll want a record of the transaction” as if there isn’t a list of transactions in my freaking bank account. I can’t imagine what a headache it must be for him to collect, cash and file two dozen rent checks every month.

Pay your taxes before you pay anything else. It’s easy to do with the federal and state withholding that is done for you if you have W-2 income, but if you’re an independent contractor or do some other work that is reported on a 1099, make sure you pay your quarterlies on time and in full. I got in some trouble with the IRS over quarterly estimates and it’s like owing money to the mafia. It’s debt that you don’t want. The IRS will punish you severely with a multitude of tools, from penalties and interest, to wage garnishment, to asset seizure, and in severe cases, criminal charges and prison time. Federal tax debt will also result in a lien if you own a home and your credit will be destroyed. Don’t mess with the IRS!

“In the US, it is apparently normal/acceptable to have a separate credit card for every major chain store and to pay with checks, credit, money orders, cash and debit cards in that order (not really, but kinda).”

My parents are like this. Pretty much every retailer will have a huge discount on the first time you use their card, so they’ll get it for the one time 20%, then just continue using that card at that store. I would rather pay the $5 more and not have to deal with an additional credit card company.

Though it does pay if, say, you decided to tackle a big project on your house and are about to spend a few thousand dollars at the home improvement store. Grab their card, get the few percentage off, and close the line of credit.

The most important advice is simple… SPEND less than you MAKE.

However, that is often easier said than done these days. Here are some books that are very good at helping form a mindset that will make you financially successful (no matter how much income you have). In no particular order…

The Millionaire Mind – Thomas J. Stanley (This author has a couple of other great books too)

Financial Peace – Dave Ramsey

The Total Money Makeover – Dave Ramsey

(the above two have somewhat of a religious theme… but don’t let that turn you off, the financial advice is some of the BEST out there)

Debt-FREE U – Zac Bissonnette (specifically about staying away from huge college loans)

This has been the most important tool for me as an adult-ish personhttp://www.nytimes.com/interactive/2014/upshot/buy-rent-calculator.html

(there was an older version of this calculator that i liked better, but I can’t seem to find it anymore)

It’s critical to understand the different ways that owning a house costs money, and roughly where the tipping point is that renting is a raw deal.

Read, Total Money Makeover by Dave Ramsey

My life totally changed when I got out of debt. I no longer own a credit card and never will again.

Pay cash for everything except your home, NEVER buy a new car off the lot, worst investment ever.

I didn’t think I could live this way until I stuck with it and made it work.

I don’t think balancing a checkbook is actually that important a skill these days but it’s still worth understanding the concept if only to increase the sophistication of the way you think about money.

I really enjoy the finance blog http://www.mrmoneymustache.com/ TLDR: A couple retired at the age of 30 to raise their child. I think almost anyone could get something useful out of reading it.

I’ll echo that on the Dave Ramsey stuff. I’m listening to the Financial Peace course right now, the religious tone can be strong at times, but all of the financial advice is top notch. It’s making me rethink how I do some of my finances.

One thing I learned early about credit cards was that if you carried two different rates on one card because of something like a balance transfer, all of your payment would go towards the lower rate, maximizing your interest. Several years ago a law was passed forcing banks to apply payments to the higher rate, which was great. There were other protections too but that was a big one. In response to that, banks started offering people “business” cards to get around the law, so don’t get one for personal use.

I was home-schooled throughout High school, and my mother taught me a personal finance course. The course was through Dave Ramsey. I would totally recommend this course for anybody. They have courses to teach how to get out of debt, basic finance knowledge, and investing 101. I’m only 21 years old and I look at money completely differently than 99% of other people my age, and I credit this totally on the Dave Ramsey course.

If you have a checking account, you should get a copy of your bank statement every month and balance your checkbook for the simple reason that banks make mistakes. A few month ago I caught a $100 error the bank made on my account in their favor. If I wasn’t balancing my checkbook every month, I would have been out that money and never even known it.

One important thing I think most ppl should do is to sum up all your fixed expenses, because it might be more than you realise and it allows you to see where you can cut back, if needed.

For example:

Rent, mortgage, insurance (for house, car, family, pets), water, gas, electricity, gas (for the car), car payments, student loans, cable TV, broadband, phone, clothes, haircuts, food, buss/train pass, magazine prescriptions, lottery tickets, awesome website memberships, etc. etc.

What I’ve done is that I’ve added all these things up and that way I know what I should have left of my salary each month. From this I can make decisions whether or not I can buy something or not, or how long I need to save up.

In the UK we have loads of financial advice websites and Martin Lewis’s website is probably the best known.

Personally i learned the hard way, having a budget each month is great and allows you to know how much spare cash you might have, but you also need savings. Not only for “fun” stuff, but in case things break. I’ve just had two tyres blow out on my car, the cost to replace isn’t much, but the leak in my house and my choice to buy other things necessitated the use of savings.

Plan for the unexpected!

I’ve never actually used a credit card. I did have one, but it has long since expired.

In college I lost or had to stop my checking card, I don’t remember exactly why, and so I had to regularly go inside to bank (Wells Fargo) for a few weeks to take cash out till the new card came. EVERY SINGLE TIME I took money out they would ask me to sign up for their credit card, and then I had to find my way out of this conversation as to why I didn’t want it. So after this happening about 3 times I finally just said fine give me one, simply so they would stop asking.

The only experience I have with overdraft fees was when I was driving from SF to LA and I over drafted maybe 3 times during the trip. I knew ahead of time that it might happen because I knew the balance was low, but at the time I really had no way to transfer money because I couldn’t do it on my phone. So after buying Gas, Food, Snacks etc. I had like $75 in overdraft fees. They ended up refunding all of them except for one, which still sucked but was reasonable.

As far as ‘balancing’ goes. I have a custom web app I made that I run on my Raspberry Pi where I track all my expenses. I have money in multiple banks, and this makes it super easy to see how much money I have and filter by certain categories etc. I then have a report I made with excel where I can visualize certain things, like food expenses by year, or count how many times I’ve gone to a certain restaurant etc. It is a bit cumbersome but its pretty easy to just pull up the transaction log from each bank a couple times a month and plug it in there. The absolute hardest part is remembering what I paid for in cash. I know they have some apps that do this kind of think automatically but I don’t really like having to give them my bank account info.

Here is an example chart of where I go out to lunch most often:

As I was growing up I always saw my parents juggling how to pay off the credit card, and they still do. As an early teen it struck me that I never wanted to be in that position; one day they got me a credit card (I didn’t really want it) and it went unused for several years – mostly because I knew that on a personal level, credit and debit should work on a 1:1 ratio, as in any time you spend on the credit card it’s in the knowledge that you’ve got to have more than that amount in your account.

I never really got any lessons and I never really got talked to about it, I just kind of observed how my parents – and by extension, other people – were dealing with their finance and it always made me uneasy because they always doing the minimum payment. The idea of accruing endless debt always left me with a disturbed feeling.

I really only use the credit card as a safety net with major purchases, as a method to prevent money loss.

Eh… I’ve listened to a couple of Dave Ramsey shows and just can’t tolerate his right wing moralizing. He also gives some rather silly advice to people living in a high-value housing market like California. Don’t buy a house unless you can do it on a 15-year loan? Haha… good one.

I’ve had credit cards since I was 18. I have never carried a balance beyond the monthly payment date and never paid interest. This is partly because my parents had me paying bills and looking at account statements years before I went to college, and partly because I can do basic arithmetic and I’m not an idiot. At no point did I ever think a bank was likely to forget about the money they gave me,

This episode really reminded me of how lucky I am to have parents who have a really deep understanding of business and finances. From a fairly early age they taught me to look for the profit margins, and identify business strategies in everything. Realizing, and respecting, the profit-oriented nature of the world makes it a lot easier to watch out for predatory business tactics, without feeling paranoid and hiding money under my bed. It’s just like playing a game, if you know how you would try to win (make money), it’s a lot easier to anticipate how someone else might try to do the same.

I’m 22 and have never used a credit card, but I realize I may need to in the near future, so I’ve been thinking about the best way to approach it. My brother makes a habit of maxing out, then fully paying off his card every month, avoiding any interest or fees while racking up frequent flier miles and other credit card “bonus points”. I haven’t done much research on the topic yet, but I think that could be a great way to learn your way around the safe use of a credit card; learning how to exploit it. I know there are online communities built around this sort of thing, pushing the terms of their credit card contracts to the legal limit and racking up a profit along the way, spending a few months doing that could be a more rewarding exercise in finance than learning to balance a checkbook, so if you are thinking of initiating your children into the world of finance, this may be an interesting approach to consider.

My wife completely changed our personal finances and retirement after reading the book “The Richest Man in Babylon” by George S. Clason. We can’t recommend it enough and we give copies away to friends and especially teens. It will change the way you view and save money… painlessly.

http://www.amazon.com/Richest-Man-Babylon-George-Clason/dp/0451205367/ref=sr_1_1?s=books&ie=UTF8&qid=1430252304&sr=1-1&keywords=richest+man+in+babylon

Books:

That’s a good starter for books. I did the whole Dave Ramsey thing with my parents when I was in high school. Dave Ramsey is great if you have a lot of debt and need motivation and help getting out of it quickly. Robert Kiyosaki is much better for investing and thinking about money.

My wife graduated from school with ~$12k in student loans. When I started school the next year I took out the max subsidized loans I could (deferred interest) and we used them to pay off her student loans. We also used a little for my tuition, but otherwise paid cash. Later in school, we were paying cash for my tuition and paying off my student loans. Five years later I graduated with a Master’s degree and ~$24k in student loans. I’ve only been out of school a year and my wife has stopped working to be a stay at home mom, but we’ve still paid off more than half my student loans.

We’re currently looking for our first home (we owned and lived in a mobile home while in school). We’re looking for a duplex-quadplex so we can let someone else pay our mortgage for us. I’ve spent the past two months learning everything I can about the process so I can find a good first investment without any surprises.

We don’t have or use credit cards. We own a car, but don’t have car payments and will pay cash when we get our next vehicle, and yet our credit score is over 800.

We also don’t budget. Any expense over $50 that’s not a necessity (like groceries, utilities) is talked about before someone spends it. We use a strategy called “false sense of scarcity” where we pretend to have no money no matter how much we have. We also use a “pay yourself first” strategy where we pay ourselves, then bills, then earmark some for groceries, and the rest goes into my student loans. If there’s a big expense coming up (like a family vacation), we’ll use a little of the rest of the money to save for that for several months beforehand.

I’ll end by saying that only one of us has ever worked at a time and we make a relatively low income. I don’t even make a lower-middle class income (although I’m working on improving that). But we have enough in savings to live for over a year if I lost my job. This is something practically anyone could do and you don’t have to budget, but you do need a plan, and you have to stick to it.

Judging by your Taco Bell expenses, you must spend a fortune on underwear.

I’ve been meaning to correlate that data.

Restaurant Visits vs New Underwear by Date.

When the revolution comes…. do you think I can get a pardon if I’m wearing a Tested t-shirt?

IMHO best book about the system (Not For Kids), “The Asylum” by Leah McGrath-Goodman

Great podcast Great quality!

This is hands down the best financial advise / resource I’ve ever come across https://www.lds.org/topics/family-finances?lang=eng

the 2 books dad told me to read after graduating college in 2013 were the Ramsey book mentioned here and Clark howard’s living large in lean times.

http://www.amazon.com/gp/product/B004RKXHGS/ref=oh_aui_search_detailpage?ie=UTF8&psc=1

But i was raised pretty well and for better or worst… pretty stingy lol.

Balancing a checkbook was one way for people to pay attention to their spending. It required that you maintain your balance and the checks that you wrote. With this information, you can see what checks have “cleared” the bank(e.g., cashed by the recipients). You cannot rely on the outstanding bank balance because one or more of the checks that you have written may not have been cashed. I seem to recall that checks in Europe go straight into a person’s account, not so in the US.

I rarely write checks now, all of this was before debit cards.

Part of the mystique of balancing a checkbook is learning simple arithmetic! The checks are written “Pay to the order of Acme Wondertoys the amount of Five hundred thirty-three dollars and seventy-nine cents,” with your signature and account number as the authorizing key (although banks have been known to let checks through without a signature…).

Along with the pad of checks, you also have a ‘register;’ a simple spreadsheet (hard-copy). You record the amount of money you deposit in the account at the top of the first page. Then, as you write checks, you record the amount of the check and keep a running total of how much money you have left. You can add more money, and it just adds to the running total.

At the end of every month, the bank sends you a list of all the checks they have received for payment, and show how much money -they- thin you have left.

The ‘balancing’ part is where you compare their arithmetic to yours, taking into account deposits they haven’t added to their books, and checks that you have written that have not been presented for payment. And taking into account any fees they subtract from your account: a fee for having a balance below a certain limit; a fee for too many checks written against the account in a single month; etc.

If you have spent more money than you have in your account, (ie you have a negative balance), you are ‘overdrawn.’

Remember: “I can’t be overdrawn– I still have checks left!”

–Paul E Musselman

You need to work for a better company– the one I work for issues company credit cards. You’re still responsible for filing the expense report, but once approved the company pays the credit card company directly. But it’s only for company expenses…

–Paul E Musselman

How to learn about money– I’d recommend the Suze Orman show, on PBS. She talks about money and how to deal with banks and cards and all of the other pieces. She also has a segment on her show where people ask if they can afford something. Sometimes they’re told the purchase is approved, other times it’s denied. And she explains why.

One thing she stresses is building up a reserve fund, enough money to pay for 6-12 months of your normal living expenses. This also comes in handy when you need a pair of new tires that you didn’t budget for!

And you also need to pay into your retirement fund. Don’t help the kids with school; your retirement fund comes first! There are no scholarships for retirement!!

Personally, I got myself in debt to MasterCard (it’s called a ‘Master’ for a reason!), I was running not hand to mouth, but the balance on the credit card wasn’t going down, even with doubled payments. It was depressing, to say the least! The best solution would have been to stop spending, but I’m an addict…

My way out was because I had a house and a mortgage– and enough equity to pay off the card. It’s a dangerous move– most financial advisers caution that you can get yourself into worse trouble if you pay off the card, but keep adding the same monthly credit-card debt PLUS making another house payment! You can lose the house, too.

And the bank did ask what my ‘official’ monthly payment was, and how much I was actually paying. And, because I was paying more on the card than required, the bank was kind enough to give me a loan, at about 1/3 the interest rate that my Master was charging. That difference in interest rate (about 19% vs 6%) was the key to actually paying off the principal to the debt I’d acquired!

The instant I was able to send my Master a check for the entire outstanding balance, it was like 500 pounds of worry disappeared. Instantly. Not having a ‘convenient monthly payment’ is so nice!

Since then I’ve paid off the card in full each month. And, deadbeat that I am, I let them pay me ‘bonus bucks’ as punishment!

The real moral of the story is to think about that ‘instant gratification–‘ That idea about waiting in days the number of digits in the price is a good one! It helps avoid ‘buyer’s remorse–‘ the gloom that descends when you realize that whatever toy you just acquired is not really the secret to eternal bliss!

Remember– you can only buy toys with surplus money! NOT out of the emergency fund!

–Paul E Musselman

Hmm, Just remembered to cancel a credit card account that I never activated in December, I made it only to just to get a massive discount at a particular clothing store. Thanks Tested!

Great piece. BTW, my first car was a 1972 Volvo 142 – green. I have never purchased a new car and have always paid in cash.

Adam and family should sit down and watch the following Frontline episodes.

Secret History of the Credit Card (http://www.pbs.org/wgbh/pages/frontline/shows/credit/)

Financial crisis and the one person (a woman) who saw it coming. (http://www.pbs.org/wgbh/pages/frontline/warning/)

The two should be required viewing in college.

Finally, a nasty roommate (or the boyfriend of a nasty roommate) can mess up your credit by stealing your mail, signing up for one your cards (I speak from experience) and using it.

Finally, Consumer Financial Protection Bureau – excellent resource for mortgages and college loans,

(http://www.consumerfinance.gov).

Thank you Adam for your story on the Consumer Credit Bureau. You have taken the sting out of using it, I suspect that many people will try it because of your story.

My bad, Consumer Counseling Bureau

I think I very good lesson for everyone to learn is when they are the customer and when they are the product; and how often they are both!

I would recommend Mint as an excellent application for tracking your finances. Looking at it the right way allows you to leverage game theory to make your Net Worth like a new High Score!

As for podcasts or other online tools: I’ve always enjoyed The Motley Fool, Freakonomics and Planet Money. Lifehacker will also often have interesting bits on finances and securing your personal information online.

Some books that have been helpful are The Wealthy Barber by David Chilton , Growing a Business by Paul Hawken, Your Money or Your Life by Joe Dominguez and Vicki Robin, and Small Time Business Operator by Bernard P Kamoroff, CPA.

The last bit of advice I received from a friend in the credit industry: If you have a credit card, freeze your limit where you want it and don’t allow the bank to increase it if you yourself don’t ask for an increase. Also, have a second credit card for use online that has a limit of only a few hundred dollars. If it’s compromised, there’s less to worry about while things get sorted out. Lastly, use credit rather than debit. If your card is compromised, money from a debit card may not be available to you until the problem is sorted by the bank. With credit, the bank also has a greater interest in solving the problem fast! In short, better to have it be the banks money that needs sorting than your own!

And one last thing!

While having a credit history is a good thing, remind your sons that too much available credit can be worse than no credit. For things like a mortgage, banks will look at how badly in debt you could potentially put yourself, not only how much in debt you actually are!

My parents taught me squat. Ended up taking accounting in high school. And my sister bribed me to read “the wealthy barber”.

Most of us have probably seen Adam’s Volvo before…

I’d like to add another vote for Rich Dad, Poor Dad … Changed the way I viewed my finances 🙂

Many years ago, before internet banking, I bought a car on credit. I mostly made the payments on time, but I didn’t keep track of automatic payments going out of my cheque account, so sometimes the automatic payment on my car would be dishonoured and I would get a very rude letter from the car credit people saying I had seven days to pay or they would repossess the car. From this experience I learnt to write regular payments on a calendar and each pay day I could see how much was going to come out of my account before the next pay day, and I could then calculate how much I could spend, with some left over. I still check my balances everyday and think about how much money I have until next pay day. Man, I love pay day.

Was never thought anything about finances and went through the same thing as Adam. Just ignoring the bills for quite a long time. Don’t blame my parents. They never had any problems and didn’t forsee anything going wrong with my financial situation. But it did, it was a good lesson, but it did cost a few years of my life. And I can only blame myself.

Took me hard work and determination to get out of debt. And of course meeting the right woman who kicks your ass to get you back on track helped a lot in my case.

Later worked for 3 years at a company that negotiates debt, much like Adam describes. Just to pass on the hard learned lesson.

Now I just go by one motto: don’t spend money you don’t have.

I don’t even have a credit card (payed my dad to get me my premium membership with his creditcard 🙂

Banks know who’s an easy target for sleazy loan deals to keep/get you in debt. That’s just the way they make money. Don’t watch too many documentaries about banking because you’ll lose faith in humanity. I think it was one of the Zeitgeist movies that explain that every dollar bill supplied by your bank already comes with debt. And continuously keep printing money so it will lose it’s value even more. Can go on, but Tested is a happy site XD

Maybe bitcoin isn’t such a bad system after all 🙂

Thanks for a good Still Untitled episode.

I think it’s very important that the school system makes our

children ready for the real world.

How I learned about tax:

To teach my brother and I about the tax system and why we have to pay tax. Our dad took 10% of our Saturday candy. It hurt and we felt it was unfair. But, he said, “You will surely like picked up from school and be driven to swimming lessons, right?” Then pay.

It must be said that it always happened in a teasing tone and he loves candy 🙂

Looking back on it as an adult. It gave us an idea of that you have to contribute to the community, in order to enjoy.

I live in Denmark and I pay about 32% in tax. So, 10% is a small price to pay 🙂

I also recommend Gail Vaz-Oxlade, her show (Til’ Debt Do Us Part) helps couples struggling to get out of debt and get past bad money decisions. She takes the time to explain what they did wrong and how long it would take them to pay back the debt they borrowed at the minimum payment scheme (some are on the brink of bankruptcy). She’s written a few excellent books as well, Easy Money is her most recent. Great podcast, something we should all be teaching our kids early on!

Financial Peace is a great course. It changed my life.

I can’t recommend YNAB (You Need A Budget) enough. It’s a fantastic piece of software (works on all OSs and devices) that helps you set a budget, keep your budget, see where your money goes, set up emergency funds, etc. Think balancing your checkbook for every single one of your accounts.

Perhaps this isn’t “financial advice” in terms of understanding how credit/interest/etc works, but YNAB is the best thing I’ve seen yet at keeping me from overspending. Also, they have webinars on how to use the software and make it work with whatever your situation is.

Disclaimer: I do not work for YNAB and have no connections to the company other than being a happy user of their software.

I feel I was pretty lucky because the school I went to taught a financial planning course as part of PE of all things in eighth grade. We each has pretend careers and income and had to make budgets and they would assign budget busters like your kid needing glasses you had to figure out how to pay for

In math class they covered how credit cards work and why you don’t want to carry a big balance when the subject if exponents came up.

These days there are a lot of apps out there. Mint.com is a pretty popular one. Although there are privacy concerns if you want it to automatically log transactions because it involves linking your accounts so they can update your transaction history.

Love this… Cop’s were probably thinking is it 4:20 already?

The Dutch study-loan, as to start next year:

You can choose the amount of money you want ( €1040,- max/month) (you can change the amount monthly)

you get 35 years – after finishing your study – to pay back the loan.

The interest is based on what The government has to pay on state loans in the European bank (now less than 1%)

The maximum you pay back is 4% of your monthly income – (this depends on how much you earn)

If you earn less (or the minimum wage) you don’t have to pay.

If you have a debt at the end of your 35 years it changes to a gift (your dept goes to zero)

I will start my university education next year so I’m the first group who has to borrow money this way.

sorry for my English

The worst thing you can do is to teach someone avoid credit cards like the plague. Instead you should teach them how to use a credit card responsibly. The almighty credit score won’t be nice to those that avoid credit altogether. A friend had a hard time getting a house because they had zero credit history, was on a prepaid phone service, and they didn’t have a car either so they didn’t have any accepted way to prove they can be trusted to make timely payments, but even with that said – it’s much better to have no credit than bad credit.

Personally I have a the Amazon credit card but I use it as a debit card. Since I buy just about everything from Amazon in the first place (and when I had no credit it was difficult to get any card with rewards as nice or better as theirs) I get back what comes down essentially be free giftcards, which reduces how much needs to be taken from my bank account in the first place.

An easy way to keep track of automatic payments– 2 checking accounts! First account is for all automatic payments. And -only- payments that are a fixed amount every month! Set up automatic deposit at work– if you’re paid every other week, have 1/2 of your monthly automatic payments deposited in the automatic payments account every pay. You’ll have to ‘prime’ this account with an initial month’s cash. And you’ll never bounce a check for the rent, mortgage, or car!

The 2nd checking account is for ‘general expenses–‘ all of the payments that are for varying amounts each month, and your ‘slush’ fund.

And a 3rd account is a savings account. Yes, I know, an interest rate of .0000005% a year isn’t anything, but this can be your emergency fund.

The 4th account is your payment to an IRA or 401K account.

–Paul E Musselman

As of a few years ago, the public school system where I live (Fairfax County, VA) offers and requires a personal finance class in order to graduate from high school.

I hated how banks nickel and dimed me, so I did the best thing: I took my business to a credit union where I’m part owner. I haven’t looked back since. I would suggest that you do the same, credit unions are the best and since they are not-for-profit, they don’t do any of the things that you mentioned banks doing.

One of the more interesting unintentional plusses I found. When I was younger to hide money from friends and girlfriends who wanted to borrow and not pay back, I would dump money into the Utilities Accounts and therefore carried a credit with Maw Bell , Power, etc. ( Back then they actually payed you interest on credit – yes it was the early Pleistocene ) and to make sure they weren’t turned off, if I lost work. But when I went to buy a house ( I had never bought ANYTHING on time before ) the loan officer said he had never seen such a high credit score before. So apparently that two or three hundred I kept as a buffer on my Utilities more than paid for itself in the ability it gave me incase I NEEDED to borrow.

That’s not true. You can always run a debit card as a credit card.

A late 90s Toyota Corrola is a good bet for a first car. Safe, reliable, easy to work on. And cheap.

You sure about that? I’ve never seen that option. (I’m not in the USA btw.)

There is only one fundamental rule to personal finance: spend less money than you earn. Everything else is just about what to do depending on where you fall on the spectrum of expenses and earnings.

If you are on the expenses > earnings side, then you need to lower your expenses and/or increase your earnings (balance your budget). Many people act like this is impossible for them, but don’t realize that they are some of the wealthiest individuals in the entire world and that most people earn much less than they do and somehow manage it. They may be in poverty, but many people do live off of the minimum wage. It is hard, they have to make a lot of sacrifices, but if someone earning $15,080 a year can do it (Federal poverty level for family of 2), so can you.

If you are on the earnings > expenses side, congratulations! Don’t mess it up. Prepare for emergencies, prepare for when you cant work anymore, and enjoy yourself. Relax and don’t worry, it could be a lot worse.

Hello Tested Crew,

My name is Ryan am 23, this weeks topic hits home with me totally taking over my debt and learning finances. I just got sick of never knowing how much money I have immediately and started tracking it. Another that instantly added relief was writing down all the things I owe money on and the minimum payment, and creating all day event for all those payment in Google Calendar. This was a huge first step because some bill payments I moved up the days and spread them out evenly so I always had money after paying off the bills for the next 2 weeks. Anything left over was “fun” money.

Next was getting the Debt Snowball calculator spread sheet, and that really puts into perspective how to pay off things faster, or realize how much you really owe. Then you can personalize your plan from there.

Always be testing,

Ryan

Hey guys, this isn’t about finances but I thought you’d find it interesting. You mentioned golf courses and their watering habits, here in San Diego I happen to know that a few of the golf courses cut down their watering significantly. Since doing that they are left with less attractive brownish grass, not exactly eye pleasing. Their workaround to keep the grass green is to paint it. Yep, they have big sprayers that drive the course and spray paint it green. It’s actually saving them money and conserves water at the same time.

My wife and I did credit counseling before we got upside down in our credit card debt and it was such a good move. Took us 3 years and we wiped out more than $40k. While we were paying that down, we got a lot better at spending less and building up cash savings that we could dip into instead of using credit cards. With all of that done and over now, we’re able to be “deadbeat” credit card users and use all the benefits of cards (consumer protection, cash flow advantages, earned rewards) without running up actual debt.

As for book recommendations, I have one book that I only recently discovered that I wish I’d read in my 20s. It has a terrible, scammy-sounding title, but the actual information is golden. The book is I Will Teach You To Be Rich by Ramit Sethi. It’s a NYT best seller and contains all that great advice that any savvy parent would give their kids. The difference is that it actually then teaches you HOW to put that advice into practice. It’s also written for the digital age and lays out ways you can use online banking and investment account management to automate your savings, your retirement fund contributions and other investments. He refers to this as a “Personal Finance Infrastructure” and the results are spectacular because you start saving and investing automatically instead of having to do those things on your own.

My favorite part of IWTYTBR, is that unlike most personal finance advice I’ve come across, it’s not telling you to stop spending $4 on coffee. Instead, it’s focused on the big wins that make tens of thousands of dollars difference over the long haul. The book is laid out like a six week course with concrete action items to take at the end of each week. By the end of week six, you’ve got your infrastructure set up and you’re off to the races. Like I said, I wish I’d read this book in my early 20s.

Also, the same author, Ramit Sethi offers a course called “Earn 1K” about starting a little side business to help supplement your income. I’ve used this to build up my own little side business that pays my shop rent and allows me to buy tools and materials for the work I do there. It might replace my day job some day. We’ll see.

Oh and Adam, the audio book for I Will Teach You To Be Rich is read by the author and he’s hilarious. That’d be a great listen for you and the Things.

Here is something that I feel should be taught in school right next to simple banking and credit awareness. How to make change to maximize your tip. Face it most first jobs are crap and involve working for tips to some extent. Something I learned delivering pizza was the proper way to make change to ensure as much as possible stayed with me.

If the total order is say $13.43 and your handed a $20 how do you give change back? Certainly not by literally handing them the change first! Doing the math the correct change is $6.57, the simplest way to make that change is a $5, $1, and $.57 in coin. The proper way to make that change is $6 singles and the coins, always handing the coins last.

By giving all singles first, then having to search for proper coinage you have now given the customer the greatest opportunity to not only give you a couple singles back but also tell you to keep the change.

In 5 years of delivering pizza this made me more in tips than anything else and was always something we passed on to the new drivers.

I’d love to see them do a podcast about drugs, legal or otherwise. Not to glorify but rather educate and inform. First time experiences and philosophies ect.

Learned my finances from screwing up. Not going to make the same mistakessssssssss twice, ok 9th time. College “free credit cards” poor career choice, cool gadgets. As far as only buying a used car, screw it. I’m 46 and have owned 2 cars. I buy new because I know there wasn’t previous owner who tortured it before dumping it. It isn’t an investment, a car will never appreciate in value unless it was a rarity in the first place that you wouldn’t be able to afford in the first place. Heck I can’t think of anything used on a daily basis that maybe goes up in value except a house.

My favorite financial podcast for personal finance right now is the Dave Ramsey Show. I know, a bunch of religious stuff is in there, but ignoring that it’s still a great set of ideas. All about getting/staying out of debt and building wealth and working hard towards a goal and career. It also discusses the importance of human behavior and how it often trumps the math. Also agree with BassDaddy about Total Money Makeover, same content in book form.

Adam specifically asked about a financial tool/program he and the kids could do together. Several people have mentioned Dave Ramsey and his program Financial Peace University. Dave has a new book with Rachael Cruz called “Smart Money, Smart Kids”. It is designed to walk through financial concepts for very young children all the way through college age. It teaches parents how to teach children about working and saving and staying out of debt (including student loans). It has only been out about a year so may not be as widely know as his other books. This was a great podcast!

my high school has a mandatory online financial literacy course called everyfi and before that was possible an in school class. i was actually surprised by you saying that your kids school did not give financial courses i amused most did mandatory like mine

The banks made interest formulas difficult to understand so the average person cannot calculate them, they did this to hide charges but were caught and now they have to disclose how they Calculate the interest but not a single Finance manager I have met can show you on a calculator how to figure your interest on purchases. My wife is an accountant and she was Telling me that her professors were unable to teach it other than to say” download an app, or use the charts for an estimate”

Does that really happen in the US? I mean, banks sending out credit cards in the mail without anyone asking for it?

Seems somewhat fiscally irresponsible.

You have to go through an application process here, as in most places I would think.

So much this. I wish I could’ve done one, I can’t save money to save (heh) myself, I don’t know why – no willpower I guess.

Unfortunately, I learned along the way. At my high school, our finance teacher DESPERATELY tried to teach everyone, but most people didn’t listen. He also didn’t have much support. It was a shame.

My high school economics class had a few days scheduled where a financial advisor would come in and talk to us about the basics of personal finance. He gave us a small paperback book that is written for a high school audience. “Money Ride: A Passenger’s Guide to Money & Wealth” by William K. Busch

Old post, but for those like me who are going backwards in podcasts…

I am a fourth-grade teacher to teach my students I use:

My Classroom Economy it gives lesson plans that are developmentally appropriate to teach about money you could totally manipulate it for home. It is a free resource

I use First Kid Bank which is a chore and allowance online tracker for students to “check their bank accounts” and my bankers to deposit and withdrawal money. Again a free online resource.

Lastly, if you want a safe place to set up a child’s bank account Colorado has the only kids bank in the world. Young Americans. They offer finance classes, loans, business loans, savings etc. If you live in CO go there for a finance class it is fantastic and push your kids’ schools to participate in Young AmeriTowne for 4th and 5th graders. They set up business, personal finances and then participate in a fantastic field trip that allows them to run the business they have developed.

Please look here https://money.solar/ A wonderful web resource for viewing interesting publications at your leisure.